SayF App

Hello friends , welcome to our website here we have a new app withHello friends , welcome to our website here we have a new app with new earning methods also you can easily earn money and daily earning is 500 to 1000 rupees in day

CLICK HERE - On Google Play Store

REFFERAL CODE - Upadhyay5316611

So , We move on the app First thing you want to download the app and and create the account and When you in app , App ask for the refer code , So you will got refer code on above the website , So Please Go and check out the refer code and please make sure refer code is required so you will type otherwise refer code is automatically enter in the App

You want to earn more money so please check out our full website and follow on the blogger

.

..

...

....

.....

......

Subscribe our YouTube Channel and Follow on Facebook and Instagram also Join Our Telegram Channel.

IMAGES:-

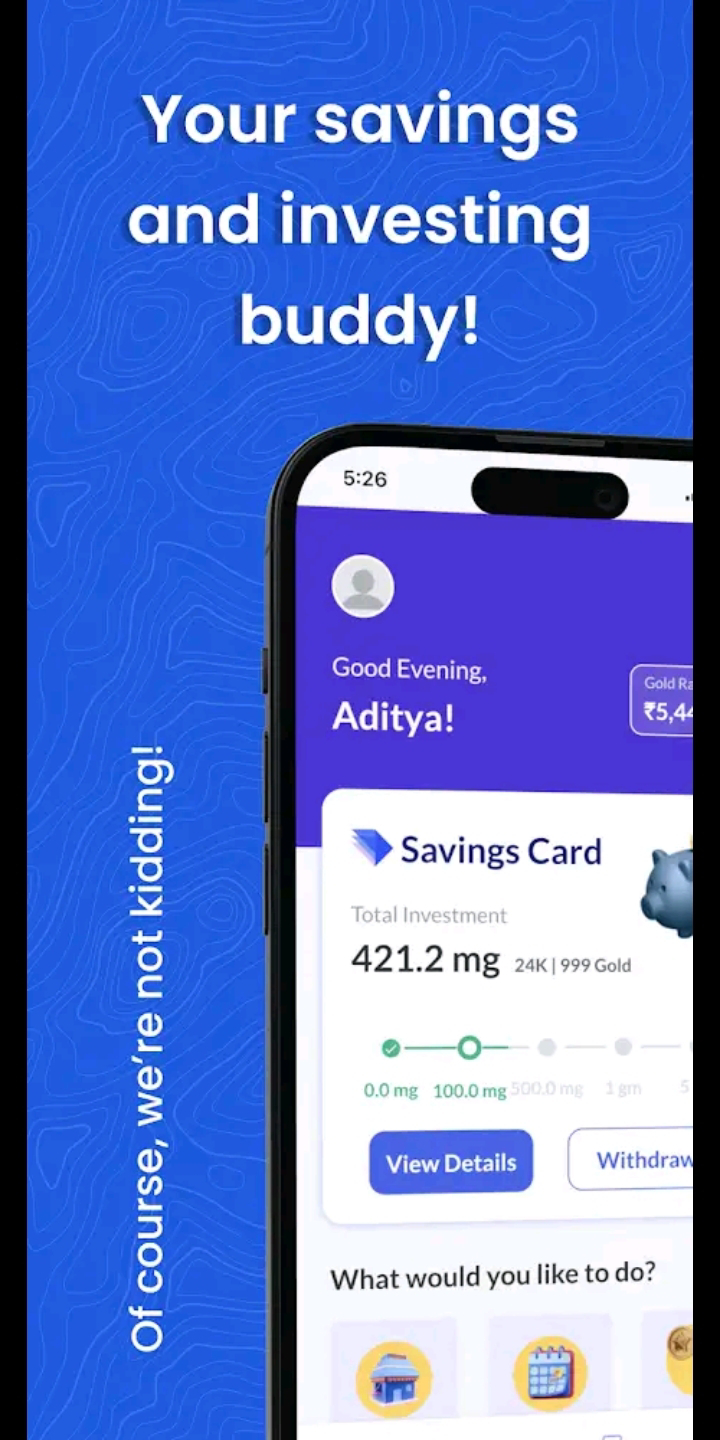

SayF: Easy Saving & Investing

SayF is a personal finance app that helps you save, invest, and spend more effectively in order to have a better future. Digital Gold makes saving and investing simple.

✰ Exclusive Stores

SayF is a personal finance app that helps you save, invest, and spend more effectively in order to improve your future. You can still make your regular purchases from all of your favorite brands, but this time you won’t just get a “normal discount.” With the SayF app, your favorite brands are investing in you for the very first time in history and you get 24k digital gold back on every purchase!

SayF invests a portion of the money you spend into 24k digital gold at no additional cost to you thanks to its partnerships with more than 300 top brands and ICICI Bank. We’ll convert 100 of your $1,000 spent on Amazon into digital gold. Now is the time to make daily investments in your way of life.

1:Bitcoin and cryptocurrencies have revolutionized the financial landscape, introducing a decentralized form of digital currency that operates outside the traditional banking system. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Since then, thousands of other cryptocurrencies have emerged, each with its own unique features and applications. The rise of cryptocurrencies has sparked widespread interest and debate, as they offer potential benefits such as increased financial inclusivity, reduced transaction fees, and enhanced security.

2: One of the key features of cryptocurrencies, including Bitcoin, is their decentralized nature. Unlike traditional fiat currencies that are controlled by central banks, cryptocurrencies operate on a distributed ledger technology called the blockchain. This technology allows for transparent and secure transactions, as each transaction is recorded on multiple computers across the network. This decentralized system eliminates the need for intermediaries like banks, enabling peer-to-peer transactions and reducing the risk of censorship or manipulation.

3: Bitcoin, in particular, has gained significant attention and popularity over the years. Its limited supply, capped at 21 million coins, has contributed to its value appreciation and made it an attractive investment asset. Additionally, Bitcoin has been hailed as a potential hedge against inflation, as its supply is not subject to the same government or central bank intervention as traditional currencies. This feature has led to increasing adoption by institutional investors and has even prompted some countries to consider integrating Bitcoin into their economic systems.

4: While Bitcoin and cryptocurrencies offer exciting opportunities, they also come with inherent risks and challenges. One of the major concerns is their volatility. The cryptocurrency market is highly speculative and subject to significant price fluctuations. This volatility can lead to substantial gains for investors but also substantial losses. Regulatory challenges and security vulnerabilities are other factors that have raised concerns. Governments around the world are grappling with how to regulate cryptocurrencies to protect consumers and prevent illicit activities like money laundering and fraud.

5: Despite the challenges, cryptocurrencies have gained mainstream acceptance and are increasingly being adopted for various purposes. Many businesses now accept Bitcoin as a form of payment, and blockchain technology is being explored for applications beyond finance, such as supply chain management, healthcare, and voting systems. Cryptocurrencies have also opened up new possibilities for financial inclusion, providing access to banking services for the unbanked population in developing countries. These advancements have the potential to reshape industries and empower individuals in ways that were previously unimaginable.

6: In conclusion, Bitcoin and cryptocurrencies have emerged as disruptive innovations in the financial world, offering decentralized digital currencies and blockchain technology. While they hold immense potential for transforming various sectors, they also present challenges that need to be addressed. As the technology continues to evolve and mature, it is crucial for regulators, businesses, and individuals to navigate the cryptocurrency landscape carefully. With the right regulatory frameworks, security measures, and responsible investment practices, cryptocurrencies could shape the future of finance and usher in a new era of economic empowerment.

0 Comments